5 Genetic Diseases in Shelties

Shelties can inherit genetic diseases of the eyes, skin, knees, hips, and blood. Discover the early warning signs and how dog DNA tests can help.

Did you know that purebred dogs are more susceptible to 10 genetic diseases than mixed-breeds? This is a result of historic inbreeding in purebred populations, allowing disease genes to meet in both parents and be passed on, double time, to offspring.

Shetland Sheepdogs are more prone to five of these diseases, as illustrated below. I should emphasize that these aren't all common problems in Shelties, but they are more likely to be found in Shelties compared to mixed-breed dogs.

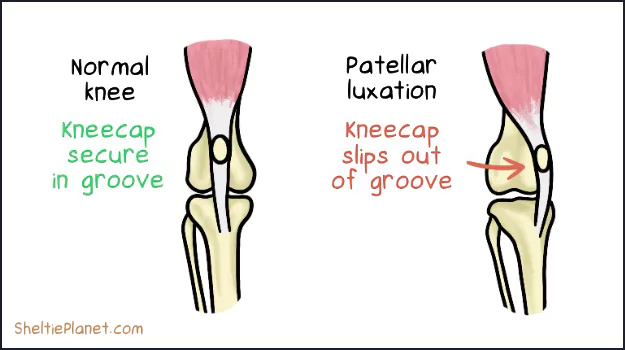

#1. Patellar Luxation in Shelties

Patellar Luxation is more often seen in small purebred dogs like Shelties. It's an orthopedic condition where the knee cap (patella) floats out of position (luxation). This causes pain and difficulty straightening the leg.

Patellar Luxation in Shelties is most often caused by a genetic fault that changes the way bones and muscles develop in the knee joint.

Symptoms of PL

If your Sheltie has a luxating patella, you'll notice her limp and hold her hind leg up while she's exercising. It may only last for 10 minutes before she returns to normal, but it's a recurring problem. If severe, she may suddenly become lame and unable to walk.

Causes of PL

A luxating patella tends to begin in mid-life (4-8 years in Shelties) and is linked to certain genetic markers in purebred dogs. It can also be caused by injury to the knee joint.

Diagnosis of PL

Vets diagnose luxating patella with a physical exam. They can also take x-rays of the entire leg and hip joint, which reveals abnormal twisting of the surrounding bones to accommodate the injury. Fluid samples from the knee area can also reveal an increase in giveaway mononuclear cells.

Treatment of PL

Treatment for mild or moderate cases of PL involves massaging the affected kneecap. In chronic or severe cases, your Sheltie can have surgery to correct the kneecap. The patella can either be surgically re-attached to the bone, or the bone groove can be deepened to better secure it in place.

Surgery for Patellar Luxation requires a 30-60 day recovery period where your Sheltie mustn't run or jump. It's effective in the short term in 90%. However, long term, around 50% of dogs have a mild relapse when the same problem returns due to general wear and tear.

Prognosis of PL

It's not the end of the world if your Sheltie is diagnosed with Patellar Luxation. In many cases, PL can be managed at home with massage and may not require surgery at all. However, if he does need surgery, it's a one-off treatment that can significantly reduce the severity of his symptoms.

"Our Tyson had Patellar Luxation. He had surgery to correct both back knee caps. He also had a pin inserted. Due to it going undiagnosed for a little while, his leg started to turn outward. Easy surgery with relatively easy recovery. Have not had any issues since." - Anne Wiseman Multani

Tyson after Patellar Luxation surgery on both back knee caps.

"My Blaze had Patellar Luxation since he was at least 6 months old. I used to massage his knees with my palm under the paw (both were affected) and gently press upward to pop it back into place for him. It was never painful for him when I did it and it was really easy to do. This only happened during heavy activity for him with his rowdy sister." - Jamie Milheim

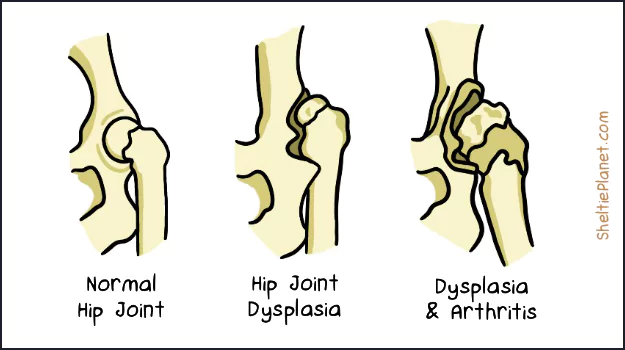

#2. Hip Dysplasia in Shelties

Hip Dysplasia is caused by the thighbone partially floating (subluxation) or fully detaching (dislocation) out of the ball-and-socket hip joint.

Hip Dysplasia in Shelties.

Hip Dysplasia usually affects large dog breeds like German Shepherd and Old English Sheepdogs. The mutation may have been passed into Sheltie populations in historic cross-breeding.

Symptoms of HD

If your Sheltie has Hip Dysplasia, you'll see him limping on his hind leg or hopping like a rabbit. He'll hesitate when rising, jumping, and climbing stairs because of the pain it causes. Other signs including holding the back legs close together while standing, a reluctance to run, and lameness after exercise.

Causes of HD

Hip dysplasia in Shelties is caused by a genetic mutation that affects the usual uniform growth rate. This causes the hip joint to deform over time.

Diagnosis of HD

Vets diagnose Hip Dysplasia in Shelties with a physical exam, blood analysis to detect inflammation, and x-rays to visualize the severity. They will ask lots of questions about the onset of the symptoms; give as much information as you can.

Treatment of HD

Mild to moderate cases can be treated with medication like NSAIDs and lifestyle changes like maintaining a healthy weight, low-impact exercise, a warm sleeping area, and massage therapy. If severe, there are various surgical treatments depending on your Sheltie's age, condition, and lifestyle.

Prognosis of HD

Hip Dysplasia is a more serious malformation that can lead to loss of function and ultimately, painful arthritis. It's important to work out a treatment plan with your vet to limit deterioration of the joint.

"Archie was diagnosed with Hip Dysplasia at 12 months old. We managed his condition very well with keeping his weight down, dietary supplements, Cartrophen injections, and chiropractic and laser treatment." - Tegan Farrelley

Archie was diagnosed with Hip Dysplasia at 12 months old.

#3. Dermatomyositis in Shelties

Dermatomyositis tends to mainly affect Shelties and Collies. It's a disease of the skin, muscles, and blood vessels that can cause dramatic inflammation.

Symptoms of DMS

If your Sheltie has Dermatomyositis, you'll see redness, scaling, crusting, and hair loss. It forms around the eyes, ears, lips, and tail tip when they're still young.

Lesions start to develop around 2-6 months old, with the worst usually seen by one year old. DMS varies in severity and may come and go over time, being aggravated by trauma and UV light. It is not contagious.

Causes of DMS

DMS in Shelties is linked to genetic mutations that may be triggered into action by viral infection.

Diagnosis of DMS

Vets diagnose DMS in Shelties with a skin biopsy to rule out similar looking conditions like allergies, mange, and ischemic dermatopathy (low blood supply to the skin). If your vet isn't familiar with Shelties or Collies, let them know that one definitive sign is a bald tail tip.

Treatment of DMS

Home-based treatments involve hypoallergenic dog shampoo and vitamin E and omega-3 fatty acid supplements.

If the skin becomes infected, your vet will prescribe a course of antibiotics. They may also suggest topical steroid cream, medication to improve blood flow, and tattooing the affected areas to protect the skin from UV light.

Prognosis of DMS

The outlook strongly depends on the severity of the lesions. Generally, though, your Sheltie will need ongoing treatment to mitigate the inflammation. In extreme cases where the muscles are severely inflamed, euthanasia may be the only humane choice.

"We had a great Sheltie boy who had severe Dermatomyositis with both skin and muscle involvement." - Suzanne Falk

Severe Dermatomyositis in Shelties.

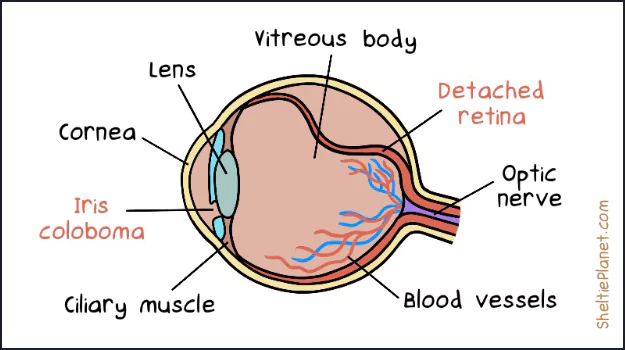

#4. Collie Eye Anomaly in Shelties

Collie Eye is a developmental disease linked with various abnormalities of the eyes. It manifests in several stages, with more severe complications leading to blindness.

Symptoms of CEA

If your Sheltie has Collie Eye Anomaly, you may not see any symptoms at first. It begins with an underdeveloped choroid (an area of blood vessels which nourish the retina), which in turn can cause the retina to fold in on itself.

Moderate cases involve bulging inside the eye which damages the internal structures. Holes (colobomas) can appear in the lens, choroid, retina, iris, or optic disc, and the retina can detach from the back of the eye. The worst cases lead to blindness.

Collie Eye can cause iris colobomas and detached retina in Shelties.

Causes of CEA

Collie Eye Anomaly starts in the womb, when multiple genes controlling eye development go haywire. It's estimated to affect up to 85% of Collies to some degree, and is a common health problem in Shelties due to historic cross-breeding practices.

Diagnosis of CEA

Vets diagnose Collie Eye in routine eyes check when puppies are 6-8 weeks old. They can spot early signs from mild to severe, including retinal detachment which can be mitigated if treated in the first year.

Some Shelties with CEA have more obvious abnormalities like unusually small eyes (microphthalmia), eyes that are sunken in the sockets (enophthalmia), or cloudy eyes (corneal stromal mineralization).

Treatment of CEA

The main treatment for Collie Eye is to surgically remove colobomas and reattach the retina. However this only repairs damaged structures and doesn't cure the underlying disease.

The only way to prevent Collie Eye is with genetic screening and selective breeding practices, thereby reducing the incidence in future generations.

Prognosis of CEA

CEA is not life-threatening but does affect quality of life if it culminates in partial or complete blindness. Not all Shelties lose their vision to Collie Eye; the severity varies from dog to dog.

An iris coloboma in a dog with Collie Eye Anomaly.

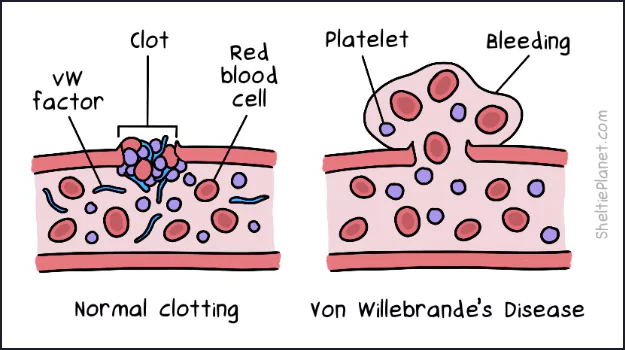

#5. Von Willebrande's Disease in Shelties

Von Willebrande's Disease causes excessive bleeding due to a lack of a blood clotting protein called Von Willebrand Factor (vWF).

Symptoms of vWD

If your Sheltie has Von Willebrande's Disease, you'll probably know about it within the first year of life. The symptoms include spontaneous nosebleeds, blood in the urine and feces, bleeding gums, blood loss after surgery, and excessive vaginal bleeding during female heat cycles.

Von Willebrande's Disease is caused by a lack of vWD clotting factors.

Causes of vWD

vWD is caused by a genetic mutation seen in an estimated 23% of Shetland Sheepdogs. There are mild and severe forms, depending on whether the disease gene is inherited from one or both parents.

Diagnosis of vWD

Vets diagnose von Willebrande's Disease with a physical exam, blood and urine analyses, and a buccal mucosa bleeding time (BMBT) test in which they creat a small injury and monitor platelet clumping defects and vWF deficiency in response.

Treatment of vWD

Most Shelties with mild to moderate Von Willebrande's Disease have a good quality of life without any specialized treatment. Even severely affected dogs can live well—as long as they receive a blood transfusion before any surgeries to prevent high levels of blood loss.

Because vWD is a lifelong condition, you need to be vigilant watching out for bleeding episodes. Take her to the vet if you have any doubt and they will decide if she needs an emergency blood transfusion.

Prognosis of vWD

As long as vet care is available for any bleeding emergencies, Shelties with vWD can have a normal quality of life and live as long as unaffected dogs.

How Dog DNA Tests Can Help

If your Sheltie comes from a puppy mill or pet store, there's a higher risk she's carrying a genetic disease. Such breeders notoriously forego genetic screening of the parents, which would otherwise prevent known disease genes from being passed on.

To find out if your Sheltie has a genetic disease, you can perform an at-home Dog DNA Test. It involves taking a cheek swab and mailing it to the lab. In return, you'll get a detailed report on her susceptibility to 210+ genetic health conditions, drug sensitivities, and blood disorders.

Get a dog DNA test at Amazon from $139.

If any genetic diseases are identified in your Sheltie, take the report to your vet who can advise on preventative measures or early treatment.

Also note the presence of the multidrug resistance mutation, MDR1, which is prevalent among herding breeds. The MDR1 mutation makes Shelties more sensitive to the negative affects of certain medications. This includes treatments for fleas, diarrhea, and cancer, as well as commonly used anesthetics.

How to Groom a Shetland Sheepdog

Shetland Sheepdogs have luxurious double coats, which come with the responsibility of routine grooming. Here's my step-by-step guide to de-shedding the undercoat.

The Best Grooming Tools for Shelties

The Shetland Sheepdog's double coat demands 3 specialized dog brushes: a detangling and de-shedding comb, a fine-toothed comb for knots, and a slicker brush for finishing.

A Brief History of Shelties

Nope, Shelties didn't evolve by breeding smaller and smaller Rough Collies—they actually date back 300 years to Scandinavian dogs imported to the Shetland Islands.

Sheltie Puppy Development in Pictures

See Sheltie puppies growing into an adult dogs in pictures: tiny newborn dumplings, plump 8-week furballs, gangly coyotes, and billowing fur beasts.

10 Most Popular Dog Breeds

The average dog lover can recognize 25% of dog breeds. Why not more? While there are 190 dog breeds to choose from, pet owners tend to favor a select few.

Overcoming a Fear of Leash Walking

Some Shelties develop a serious fear of leash walking, creating neurotic behavior when it's time for a walk. Here are 7 steps to overcome her fear of the leash.

The Pros and Cons of Neutering

Neutering a male dog means surgically removing the testicles, stopping him from roaming to impregnate females. So what are the downsides?

What is The Best Dog Food for Shelties?

Here's an in-depth review of the best dog food for Shelties, examining dry dog food ingredients, healthy kibbles, toxic foods, and oral health.